The primary concern for family offices, HNWI, and institutional investors is wealth preservation. Growth is great, but the most important thing is not to lose, or at worst, to minimize losses. Wealth is to be preserved for succeeding generations, to be reinvested in new ventures. This harkens back to the millenia old mantra, “don’t eat your seed corn,” that anyone who has ever had a garden knows.

However, by what metric are you trying to preserve the value of your wealth against? Inflation? Economic Growth? Stock indexes? Investors first of all try to minimize risk, often at the expense of growth. There are valid arguments that minimizing risk too much costs more than it saves, that you must accept some degree of volatility in returns to maximize your gains long term. The greatest profits are taken when markets are most volatile. This is when inefficient models are discarded and market clearing prices improve the efficiency of the most enterprises through natural selection.

What do you do when the very foundations of the economic system shift? For instance, the shift from the agricultural age to the industrial age marked a huge shift in wealth from the landed gentry to industrialists. The aristocrats that controlled most of the land lost out immensely by comparison to the massive growth in wealth of industrialists, even if they thought they “preserved their wealth” by not losing too much land, or even by gaining land, the comparative value of that land, compared to the massive growth in the value of many industrial enterprises, meant that the actually lost an immense amount of wealth relative to those who gained.

Aristocrats who invested in industry, who took the risks of new enterprises and technologies, were able to keep up with the shift and were able to preserve their wealth, while those who hedged and fought to preserve what they had, lost tremendously, in the coin that mattered most to them: their comparative status in the established economic order.

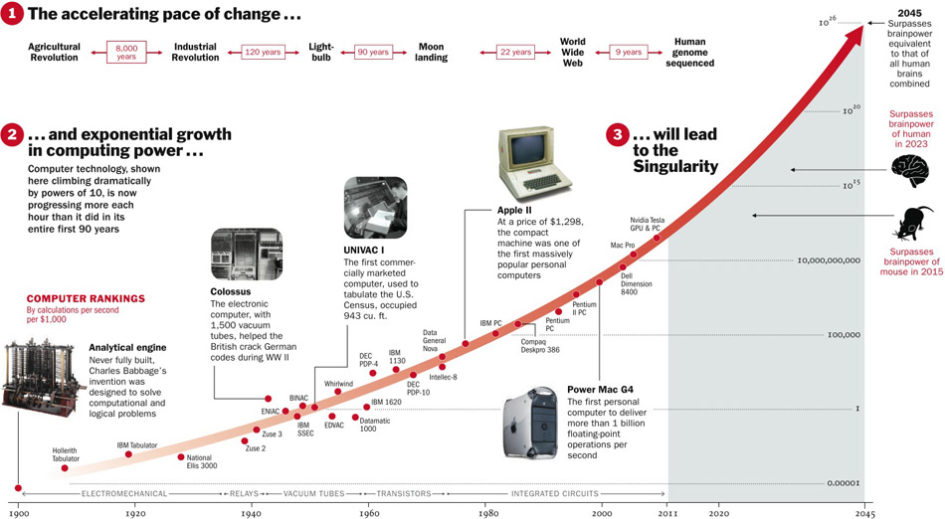

The same thing happened as the world shifted from the industrial age to the information age. Today’s titans are largely tech innovators, and their wealth continues to expand at a significantly faster rate than those who built their wealth on industry, resources, or other more traditional markets. This process is only going to continue. Not only continue, but ACCELERATE.

We call the age we are entering The Technological Singularity, but it might as well also be an economic one. People like Gordon Moore, Vernor Vinge, and Ray Kurzweil have written extensively on this. Moore’s Law of exponential growth in processing power and reductions in the cost of processing power has been developed and expanded by others like Vinge and Kurzweil to apply to all economic spheres as a whole. Essentially every innovation follows a third order S curve, of development, growth, and maturity, but all the innovations as a whole compound on top of each other to form a hyperbolic exponential curve over time.

As technology gets smarter, the 18 month doubling period of Moore’s Law on processor power shrinks, because smarter tech improves humans ability to design the next generation of tech, faster, smarter, cheaper. Eventually technology is innovating new technology. We are already seeing this, as recent news shows that an Artificial Intelligence is now designing the next generation of AI, another AI has demonstrated the ability to have emotions, and still another is able to predict stock prices further in the future with greater accuracy, than any human in history. The next generation of AI will develop even smarter AI, etc etc. These improvements in intelligence translate economically into vast accelerations in economic growth in sectors where that technology has an impact, and the smarter AI gets, the more sectors it can apply to, from predicting stocks, and making production lines and distribution systems more efficient (Amazon.com) to replacing doctors, lawyers, and even artists.

The key component of the very idea of the Singularity is that there is an event horizon beyond which it is impossible for people of our intelligence to envision what is going to happen, what changes and technologies will appear, what economic choices to make. How is an investor supposed to preserve their wealth when the window they can forecast becomes shorter and shorter? How can they hope to preserve that wealth if they refuse to take the risks of investing in the technologies of the Singularity? Today’s wealthy risk becoming as poor and outmoded as the landed gentry of old feudal europe, renting out their castles to wealth industrialists, trying to marry their daughters off to the more successful.

It thus becomes paramount that those who wish to preserve their wealth must take greater risks with transformative technologies that will shape the future, will disrupt it, and change the very foundations of civilization. You cannot shy away from disruptive technologies. You do need to become educated about it, understand it, so you can make the most informed decisions you can about which ones are the best to invest in. This is where you need to rely on people in these technologies to help educate you about them. You cannot afford to avoid this.

Leave a Reply