Today, at the time of writing this, the SI is down 124.77 from 4460.56 to 4335.79 since last week or so.

OK, so to be fair, we are still validating (fine tuning) the weighting algorithms but in the same time period the NASDAQ dropped 247.83. It’s interesting to note that so far historical analysis shows that the SI is more stable than the NASDAQ. Which is expected based on the fact that the SI selection criteria is much higher than that for the NASDAQ.

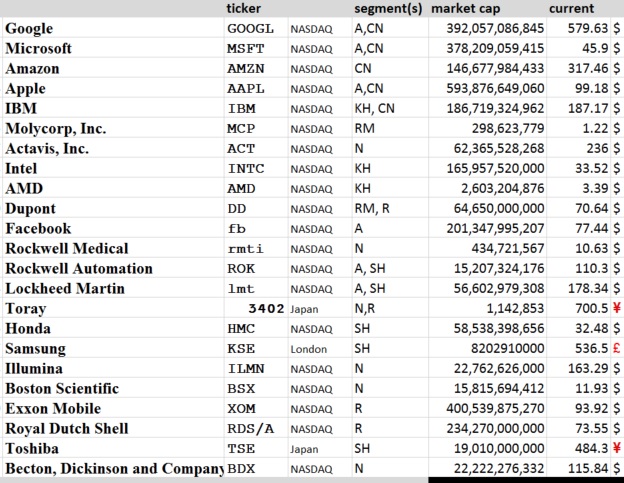

The SI use’s 23 companies along 7 verticals that are critical to achieving singularity, while the NASDAQ and SI use a similar weighting system based on market cap and a stabilizing devisor the criteria for Company selection is somewhat different as the NASDAQ is a composite index and the SI is a specific index. That being said, there is significant cross over in the sense that most of the SI stocks are listed on the NASDAQ but includes stocks from the London Stock Exchange and the Japanese Exchange.

Figure 1A – Index Pricing Sheet for the Singularity Index (p1)

For selection criteria, the SI is still working with preliminary criteria and tightly controlled around key verticals. This criteria is weighted based on Research and Development and other factors for that sector where once selected an additional weighting is used that includes market cap and other industry factors as well. Some of the basic requirements for the SI include being publicly listed which implies they are larger enough to matter, in a given vertical related to Singularity from AI and Hardware to critical raw materials and resources along with the undisclosed criteria that determines final selection.

Some of the companies are not a surprise like Google but, let’s look at a few of the more ‘unexpected’ stocks on the index:

Molycorp, inc.

is a rare earth mining firm, supplying some of the rarest raw materials in the world. The trick is that these materials are critical to the most advanced technology across the board. A huge problem with rare earth minerals is the laws that have driven rare earth suppliers out of business and helped China almost corner the market save with Molycorp and a handful of other firms that prevent complete lock out by the Chinese. Examples of what they produce includes various oxides, catalysts, rare metals and rare alloys etc.. To learn more check out:

Or their NASDAQ listing here:

Not all of the companies are on the NASDAQ that includes three in particular Toray, Toshiba and Samsung.

While you may have heard of Toshiba and Samsung,

Toray Industries, Inc.

is more obscure with a focus on chemistry where they fall into raw materials but also driving some research around the human mind or neurological research and understanding the mind means understanding intelligence which goes to Singularity which is the point of the index.

You can learn more about Toray here:

And their listing here:

http://www.reuters.com/finance/stocks/overview?symbol=3402.T

Additional stocks driving research into understanding of the mind include Illumina, Boston Scientific, Rockwell Medical, Actavis and BDX (Becton, Dickinson and Company). Together 6 of the stocks on the index with a total market cap of 123.6 billion and a composite of 1238.19 at the time of this writing.

let’s talk about key sectors on the index they include AI, Key Hardware, Support Hardware, Raw Materials, Resources and Power, Neurological and lastly Consumer Technology. Obviously the AI segment selection is clear enough to the singulatarian but the additional segments support that. For example ‘Key Hardware’ includes the CPU’s that an AGI might run on and ‘Key Hardware’ is run on ‘Support Hardware’ that might include power supplies or mother boards.

As you might extrapolate that support hardware needs power and raw materials to make it and make it run. That leaves the odd one out which is ‘Neurological’ segment which is the study of the only true working AGI that we know of, being the human mind and of course there is Consumer Technology. The reason Consumer Technology is included in the index is this segment drives research in the others, this secondary factor is the reason we have the iPad vs. the slates that we had 10 years prior. The consumer technology segment drives hardware refinements and optimization which is key to helping drive innovation in the other key segments.

Lastly remember the main goals of this index is for analyzing relative movement towards or away from singularity and may or may not be used for other purposes but such use is on you and we are NOT responsible for your application of the index. Further as technology advances the criteria for selection has a process for change to adapt to new and emerging technology as well as capitalization changes that allow companies to fall off the index when supplanted and for stock switching to occur based on these factors that allows the index to stay relevant to the goals of the index over time.

* image used from http://malickndir.files.wordpress.com/

October 17, 2014 at 6:29 pm

also see this post http://transhumanity.net/introducing-the-singularity-index-a-market-index-focused-on-the-companies-helping-drive-us-towards-singularity/

October 17, 2014 at 10:43 pm

It would be nice if you provided this index on a website with active data on a ticker. They aren’t that hard to set up with php. There are services that can generate the ticker charts for you.

October 18, 2014 at 12:32 am

we absolutely will be providing that. We will be doing a cloud based API service that any one can use and a front landing page on this site that consolidates all the posts and reference material and research around the Index. We may additional provide code for integration and deserialization including ecma script (i.e. JavaScript) etc. the service out of the game will provide XML and JSON and be a RESTful endpoint running on Azure for now. Additionally we started an open source project for t.net related software projects that will be published shortly.

October 19, 2014 at 7:08 pm

It would be great to be able to buy an ETF that is tied to this index.

October 19, 2014 at 11:33 pm

There are two possible programs that we might launch of the next year including funding a mutual account tied to this as well as some one is interested in a some kind of bit coin thing (honestly I’m not that familiar with the bit coin thing they were explaining). on this side we will be publishing a cloud based service that will provide the index data to any one that wants it and we are working on additional historical data and analysis to better understand the vs other index in terms of trends as well as see how it relates to technology announcements and mile stones etc.

October 20, 2014 at 7:46 pm

It is important to understand that I am not affiliated, nor profit from, any of these companies. My objective it to lower the price of clean energy to zero to spur economic and technological growth, and help the poor who are most hurt by high (dirty) energy costs.

http://www.opednews.com/articles/Low-Energy-Nuclear-Reactio-by-Christopher-Calder-Andrea-Rossi_Energy-Policy_Industrial-Heat-Llc_Lenr-141013-530.html

For example: “There are many companies now racing to bring Low Energy Nuclear Reaction products to the marketplace. One notable company is Solar Hydrogen Trends, which claims to have accidentally discovered a way to use LENR to produce hydrogen gas from water at the energy equivalent of producing pollution free oil for about $5.00 a barrel. Their hydrogen gas producing reactor has been independently tested by two well known companies, AirKinetics, Inc. and TRC Solutions. Both companies found that the reactor works as promised, and the TRC Solutions PDF report is quite shocking. Solar Hydrogen Trends claims that their technology can be scaled down to power automobiles or scaled up to power jet aircraft, ships, and entire cities.”

Generally, the price of clean energy is about to plummet, which is highly disruptive to the conventional economy. One in three jobs in the US directly or indirectly are dependent upon furnishing “old” energy. I estimate there is about 100 trillion dollars in assets based upon “old” energy. The value of most goods is dependent upon the current price of energy.

This phenomenon (LENR) has been confirmed in hundreds of published scientific papers: http://lenr-canr.org/acrobat/RothwellJtallyofcol.pdf

“LENR has the demonstrated ability to produce excess amounts of energy, cleanly, without hazardous ionizing radiation, without producing nasty waste.” – Dennis Bushnell, Chief Scientist at NASA Langley Research Center

“Total replacement of fossil fuels for everything but synthetic organic chemistry.” –Dr. Joseph M. Zawodny, NASA

October 20, 2014 at 9:21 pm

by all means I think that is a great objective however AGI does not require ‘clean’ energy. therefore on the since its really about the largest energy suppliers or raw materials for energy suppliers. There is not empirical evidence to support any relationship and since the strict definition of Singularity is being used we only list or included points of reference in the research around what is required for AGI which is not clean at all. now if such a company is found to be one of the largest firms in the world AND publicly traded then we would have to start evaluating it and how it relates to the index and based on selection criteria could could replace the listing for one of the power companies or split a weight with and be included depending on sector influence or percentage.